Blow-Off Top: Identifying the Indicators in Technical Analysis

A blow-off top and a swing high may look similar on a chart, but they’re not the same thing. A swing high is a peak that occurs during an uptrend but doesn’t necessarily signal the end of that trend. Blow-off tops, on the other hand, are often the final hurrah in a long uptrend, signaling a likely reversal. After the massive rise, and so many people buying, there is no one left to buy. However, there are lots of people who are panicking to sell, locking in profits, or trying to limit losses. If there’s one person who seems to have the right idea in “Argylle,” it’s, as usual, Samuel L. Jackson.

- Volume plays an important role as it indicates the number of shares being traded.

- While Blow-Off Tops can present lucrative opportunities, it is important to approach trading with a disciplined mindset, ensuring that risks are managed effectively.

- They can observe the significance of these indicators and confirmations in signaling potential market reversals and the subsequent corrections.

- These are not isolated events; they happen more times than most people realize.

- The movie’s clunky prologue plunges us into his world, as Argylle (Henry Cavill) dances with and then pursues a slinky target (Dua Lipa, whose few minutes in the film may be its best).

- The price is now starting to trend back down to a more realistic valuation as mean reversion gets underway.

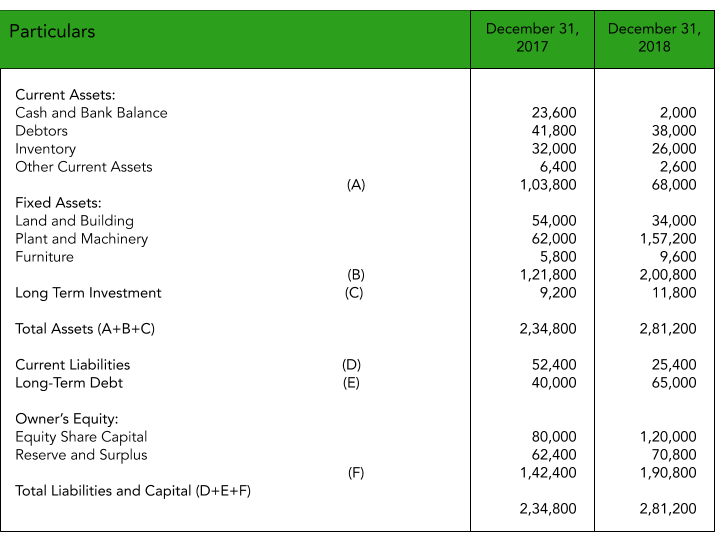

Early in the year, it traded briefly above $1,000 and briefly below $800, but then started to creep higher out of that range. By September it tested $5,000, and by October it tested $6,000. At this point, the blow-off hadn’t even started, even though the price was already higher by several hundred percent. A blow-off top has several key traits, yet it is only in hindsight that we know if it created an actual top in price.

Learn Scalping

This could mean that current prices may be unsustainable, as the lack of buying and selling pressure makes it difficult for stocks to hold onto their gains. Low volume could also mean that the stock is not actively traded, which may mean it is not as liquid and easily tradeable, so avoid those stocks. Reading volume in stock charts is simply understanding supply and demand. A high volume when a stock price increases means the stock is currently undervalued and is in demand. High volume on stock price decreases means that the stock might be overvalued and is under selling pressure.

How much further can stocks climb before markets encounter the dreaded ‘blow-off top’?

Speculative buying activity becomes prevalent as participants attempt to capitalize on the seemingly unstoppable upward momentum. Blow-off tops are often caused by a combination of speculative trading, market news, and investor psychology. When traders and investors start buying up an asset en masse, it can lead to a rapid price increase, creating a blow-off top.

TRADING HELP

Look at the progress of the S&P 500 and Russell 2000 from October 2017 through March 2018 in the following graph. It’s important to treat day trading stocks, options, futures, and swing trading like you would with getting a professional degree, a new trade, or starting any new career. Moreover, blow-off tops can be influenced by a range of factors, including market news and economic indicators. Therefore, traders should always do their due diligence and not rely solely on chart patterns. If more shares are being traded than usual, it’s often an indicator that something significant is happening with that asset. However, high trading volume alone doesn’t confirm a blow-off top; it should be considered alongside other indicators.

If you can identify blow-off tops you can better protect your capital and with the right level of skills, profit from the overreaction of other traders. So, the real answer you have to ask yourself is are you good enough that if you were to get back say 70% of your money, can you make up the 30% you loss over 1 or maybe 2 years? If the answer to this is yes, then you will get a better rate of return on your cash by taking the loss and moving on to find more profitable trades. The bottom line is that the move down takes away significant paper profits, to the point that long traders are locked into their losing positions. Now that everyone is drinking the Kool-Aid, this is where the first signs of a blow-off top will emerge.

When the sideline cash is exhausted, there is a sudden reduction in the money people will invest into equities. Demand for high-priced stocks suddenly becomes weak and, as a result, prices drop. The dynamic is one that, to some experts, the markets may be playing out right now.

This article will give you the critical knowledge to help you interpret stock price action. A blow-off top is a pattern on a chart with a steep increase (well over 45 degrees) when excluding other factors, like broad market changes. This includes a high trading volume that fizzles and is followed soon after https://bigbostrade.com/ by an equally rapid decrease that usually has a high volume. This chart pattern will look like a steep volcano cone with a slightly lopped-off tip. By incorporating these indicators and technical analysis tools, traders can increase their ability to identify and confirm the presence of Blow-Off Tops.

Technical analysis is your best friend when it comes to identifying blow-off tops. Brokers and trading platforms often offer various tools and services to help you analyze charts and indices. But remember, while the bottom of a pullback might seem like an opportunity, it could also be a trap. Your account’s performance depends on your ability to read the signs, understand market direction, and make timely exits.

Sell 50% of your holdings, and you will be playing with the casino’s money from then on. If it climbs higher, set a stop at the 50% retracement price, a sell of another 25% (half your remaining) at 60% retracement(set a new stop at 55%), and the rest at 79%. In December, delve into the ‘Forex Market Cybersecurity Impact.’ Explore breaches’ effects on currency markets, investors, and safeguarding strategies.

Falling for FOMO and buying too late can mean huge losses when that price begins dropping and fails to return to previous levels. After the initial sell-off, any counter rally is me estafaron como recupero mi dinero unimpressive with its price or volume. This is aptly named a “Dead Cat Bounce.” And those with long positions will use the reprieve in plummeting prices to unload their holdings.

As always, never put more than you are willing to lose at risk, and good luck with all your trades. The broader market can bring shareholders to their senses, seeing the asset drop and the market not believing in a recovery. Once you’ve got a handle on trading blow-off tops, you might want to explore other strategies like the 3 White Soldiers pattern. This is a bullish candlestick pattern that can signal a reversal of a downtrend, offering a different kind of trading opportunity. To master the 3 White Soldiers trading strategy, dive into this explained 2023 guide.

A volume chart will always show red bars when the stock price has decreased for the day and green bars when the price has risen. The stock here increases from $20 to $38 in the following three months, a 90% increase, but how would we know this was about to happen? Buying when the moving averages crossed over would have been a good option; it would not have provided the full 90%, but it would have produced 40%, which is an excellent result.